Mexico's growing role in U.S. supply chains is having a ripple effect into its economy, with some regions and industrial sectors benefiting more than others.

Manufacturing in Mexico has seen the production of automobiles, electronics, medical devices, home appliances, equipment and machinery grow in recent years, experts told Supply Chain Dive. The changes, which come as companies consider nearshoring production, have also driven logistics companies to increase their investments in offices or freight routes.

The United States' role in the growth is visible in trade data. During 2022, 14% of all U.S. imports by value originated in Mexico, according to data analyzed by Supply Chain Dive. Similarly, U.S. firms have long been financially active in the country, and are responsible for 42% of the total foreign direct investment in Mexico since 2006.

However, the investments have historically been concentrated in a few industrial sectors and states, a trend which has continued during the most recent nearshoring wave. Here's a closer look at Mexico's role in U.S. supply chains, based on expert conversations and data analysis.

6 sectors dominate states’ top source of manufacturing FDI

Automotive sector dominates growth

Whether through foreign direct investments or internationally purchased goods, the automotive sector has an outsized share of Mexico's top trade metrics.

In the first three quarters of 2023 alone, motor vehicle manufacturing drew $5.4 billion in foreign direct investments, more than any other full year prior. For example, BMW, which has been in the country for over 30 years, this year announced an $860 million investment to ready its plant in San Luis Potosí for electric vehicle production. Similarly, Tesla has proposed building a gigafactory in Nuevo León.

While the figure was bolstered by major automakers positioning themselves to meet future electric vehicle demand, it shows how global business dynamics can lead to waves of investments in specific countries.

"Large companies like Tesla also create a larger ecosystem of companies to support it,” said Jessica Billedo, general manager of Mexico Operations at Arrive Logistics.

Billedo detailed how China-based automation tech provider Noah Itech and Belgian glass supplier AGP Group both announced major investments in the state of Nuevo León to supply Tesla.

Besides automotive products, beverages, household appliances, electrical equipment and medical supplies are among the other Mexico-made products that have experienced rising demand, according to U.S. import data analyzed by Supply Chain Dive.

US imports from Mexico have grown the most in a few sectors

Why Mexico is alluring to shippers

Mexico has long been a manufacturing partner for U.S. buyers, but a slew of trade advantages have raised its profile for nearshoring opportunities.

The country's existing economic development and industrial maturity has helped draw investments, said Eric Porras, director of MBA and MBA-GBS programs at Tecnologico de Monterrey's EGADE Business School. Having a broad base of existing suppliers means when a manufacturer arrives and settles in Mexico, an ecosystem is already there.

Similarly, Chip Barth, managing director of TBM Consulting’s global supply chain practice, mentioned that a strong industrial presence makes it easier for shippers to reshore or nearshore, as it is likely the “knowledge, infrastructure, skilled workforce and technology already exist in the country."

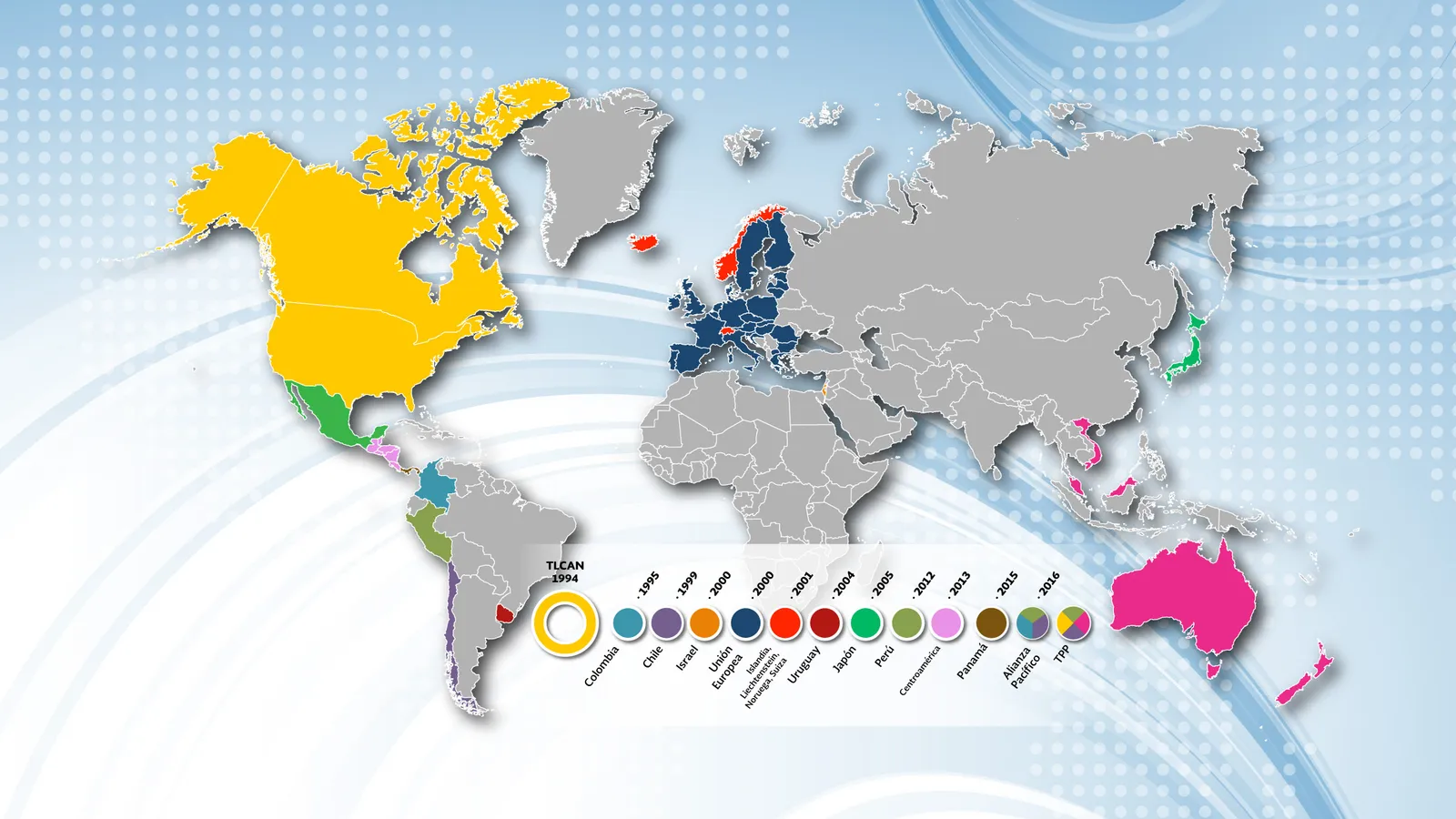

The country's global integration also helps. The U.S. has free trade agreements with 20 countries, but Mexico has 14 trade deals with 50 countries, making it an attractive destination for intermediary goods production. Additionally, the United States-Mexico-Canada agreement has strengthened the country's economic integration with its northern neighbors.

"Mexico, over many years, precisely because of the free trade agreements it has had with the United States, has developed a very important manufacturing base in different sectors — the automotive industry being a major success," Porras said.

Mexico arose as a convenient alternative for shippers who found themselves over-exposed to imports from Asia during the COVID-19 pandemic. Not only was the industrial infrastructure already present, but Mexico’s proximity to the U.S. market saved executives both time and money on shipping.

"Shorter lead times mean goods reach the end user significantly faster, which is critical in today’s customer-first, on-demand market," said Billedo. "At best, transit times from China to the U.S. range from 20 days to six weeks, whereas running a load from Monterrey, Mexico, to Detroit, Michigan, takes just four days or less."

The need for speed and agility has driven the latest wave of investments in logistics services from Mexico, particularly by rail carriers and trucking firms. Seeing shippers' rising interest, policymakers in Mexico have also proposed developing a rail corridor in the country's southeast that could compete with the Panama Canal, and save shippers days in lead times to the U.S. West Coast, Porras said.

Billedo also emphasized shippers' desire for agility in their decision making, noting many were looking to improve their crisis response abilities after the pandemic.

"Managing production is much easier when plants operate within the same time zone and are only a short flight away," Billedo said. "So, whether it’s a minor issue at the factory or a significant supply chain disruption, the proximity nearshoring [in Mexico] offers is priceless.”

Correction: The story has been updated to reflect the correct last name and title for Chip Barth.

This story was republished from our sister publication, Supply Chain Dive. Sign up here.