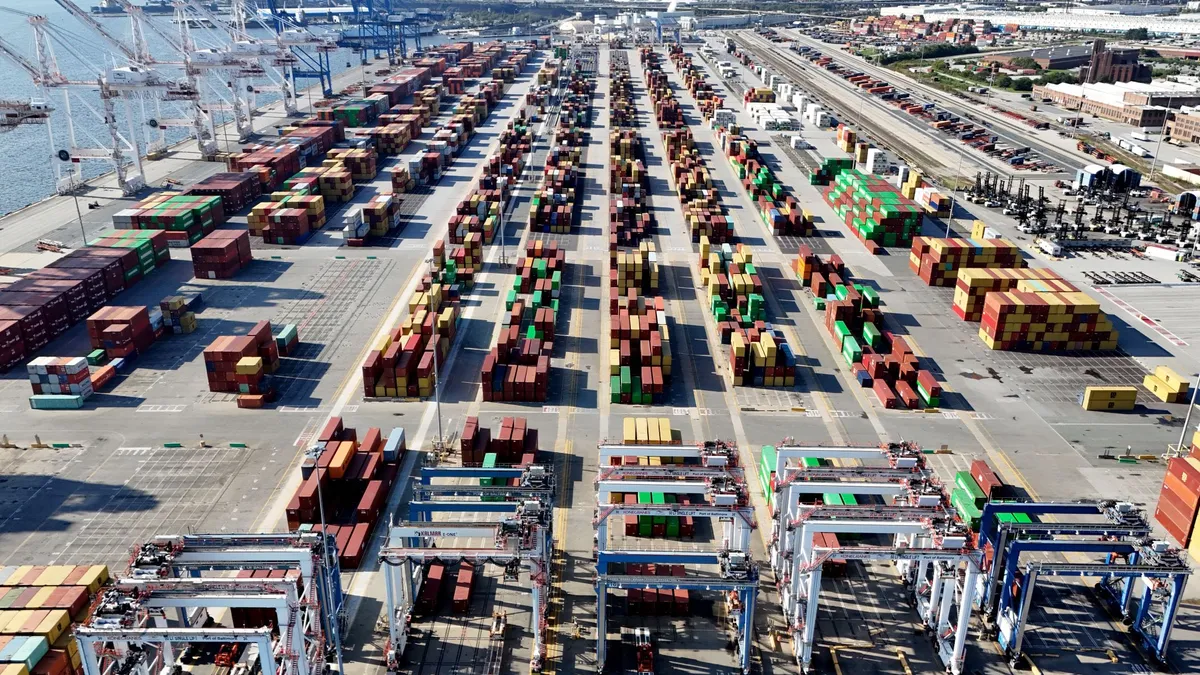

The International Longshoremen’s Association strike may have ended, but shippers are still facing cargo backlogs and freight constraints, experts told Supply Chain Dive.

After a three-day strike disrupted East and Gulf Coast port operations last week, the ILA and United States Maritime Alliance reached a tentative wage deal and agreed to extend their master contract until Jan. 15, 2025. The extension gives both parties some time to negotiate pending issues but if a master contract is not renewed by then, the union could go on strike again.

Shippers, however, are still dealing with lingering impacts from some of the terminal closures that took place during the work stoppage.

It will likely take most of October to get port operations back to normal due to the backlog of cargo and vessels caused by the strike, Vespucci Maritime Partner and CEO Lars Jensen wrote in an Oct. 7 LinkedIn post. “This will also create some ripples whereby we will see a temporary decline in capacity offered from Europe to North America,” Jensen wrote.

Before the union went on strike, some shippers diverted cargo to the West Coast and frontloaded goods to mitigate any potential impact to their supply chain operations. At the start of the strike, West Coast rail operations were strained due to high inland point intermodal volumes, according to ITS Logistics.

We asked six experts what impacts shippers are facing and what they need to focus on to better manage their freight and supply chains.

Editor’s Note: Some responses have been edited for length and clarity.

Nick Vyas

Founding Director of USC Marshall’s Kendrick Global Supply Chain Institute

With the resolution of the U.S. East Coast port strike, shippers may experience a temporary sense of relief, but the logistical hurdles are far from over. The immediate focus is clearing the significant backlog of shipments, which could take weeks and continue to strain freight capacities. Elevated freight costs and ongoing congestion at both primary and alternative ports means that delays will persist, affecting inventory replenishment and supply chain reliability as businesses prepare for the critical holiday season.

However, the bigger issue — the elephant in the room — is automation, which has been kicked down the road for now. By postponing the integration of advanced technologies into port operations, the nation risks undermining its competitiveness and efficiency on the global stage. This hesitation not only hampers the modernization of our ports but also presents a significant risk for companies considering onshoring their operations. If domestic logistics infrastructure cannot evolve to meet modern demands, businesses may seek more efficient environments elsewhere, leading to potential economic loss. To foster economic growth and maintain a competitive edge, it's imperative to address automation proactively, finding a balance that advances technological adoption while considering the workforce's needs.

Mia Ginter

Director of North American Ocean Shipping at C.H. Robinson

The U.S. port strike has ended, but the impacts are far from over. A week of disruption typically leads to at least a month of delays at the ports, and these delays increase as you move inland.

As seen in the past, when port congestion and dwell time increases, equipment is tied up longer and rates tend to increase as equipment availability decreases. Keep in mind, the U.S. Southeast is also still recovering from Hurricane Helene. While truckload capacity currently remains steady and available across impacted regions, load-to-truck ratios are rising on the West Coast. We expect this to continue as rail delays linger, elevating the need for trucks and transloading services. Air freight and expedited LCL services will likely continue to play a role in helping move priority freight as the market recovers.

Ashley Craig

Chair of the International Trade Practice at Venable LLP

While the strike was relatively short, with the complexities of global supply chains, the impact is and will continue to be felt throughout many sectors. This is due to carriers diverting cargo in anticipation of the strike, the complete closure of all terminals on the Atlantic and Gulf Coasts for multiple days - translating into holds, detentions, stoppages, etc.

Additionally, questions remain as to the new surcharges, diversion costs and operational concerns triggered by the anticipated strike and the reality of three days downtime. Shippers, NVOCC’s, forwarders and others should understand what protections and liabilities arise from your contracts if the labor unrest disrupted business operations or ability to perform.

Shippers should know what avenues for disputing charges are available and regulated entities should ensure they understand their regulatory obligations and are operating in strict compliance.

Richie Daigle

Supply Chain Evangelist at Tive

While we can all agree that complications and difficulties would have been much worse had the strike continued for a longer period of time, there will still be a considerable amount of work needed to adjust back [to] 'business as usual' all the while keeping in mind that another strike could resurface in early Q1.

So, while companies can breathe easier in the short term, it's likely that most companies are aware that more disruptions could be on the way in the not-so-distant future. Whether hurricanes, strikes, pandemics or other unforeseen destabilizing events, sizable disruptions seem to be commonplace, making the need for a well thought out plan propped up by a thoughtful application of modern technology all the more necessary. Redundancies in tracking, elevated vetting of partners and a reliance on trusted relationships are a great place to start for building such plan.

Vikas Argod

Associate Principal of Supply Chain & Manufacturing at ZS

The backlog of ships created for every day of port closure takes three to five days to clear. Three days of closure will impact TATs (turnaround times) and other port operations for the next at least two weeks, if not more. This will impact imports and exports. This disruption will propagate upstream and downstream into truck / intermodal capacity. So, expect a truck rate spike in spot (~10%), and slightly higher labor overtime in warehouses and transloading centers.

For a few weeks leading to the strike, many importers routed containers to West Coast ports. There is already an imbalance of empty containers across ports, and this will further add to the imbalance, resulting in empty container movements from West to Eastern shipper locations and takes additional spot freight capacity away and also might impact some container availability for shippers.

Angel Rodriguez

President of ASF Air at ASF Logistics

Although the strike only lasted a few days, it still had a rippling effect causing roughly a one week delay for each day of the strike. Let's be mindful that the strike has only been suspended until the 15th of January 2025, and there are still various points to be negotiated.

Contingency planning is still highly recommended regardless of mode, route or commodity. If you source from overseas, you should always be prepared for disruptions in your supply chain.

The better prepared you are with back up planning, the better you can mitigate disruptions to your customers. I don't suspect much of a downturn, if any, between the U.S. holidays in December and Lunar New Year peak. Customers should be talking regularly with their clients and planning well into Q1 '25.