Dr. Melissa Orme is the VP of Boeing Additive Manufacturing. Boeing is a member of the Additive Manufacturing Forward program launched by President Joe Biden in 2022. Opinions are the author’s own.

One of the many lessons we learned from the pandemic was that additive manufacturing — also known as 3D printing — can reduce companies’ supply chain challenges. By using 3D printing, a vast network of suppliers manufactured hundreds of thousands of face shields within weeks for medical workers, delivering immediate life-saving assistance to those in need.

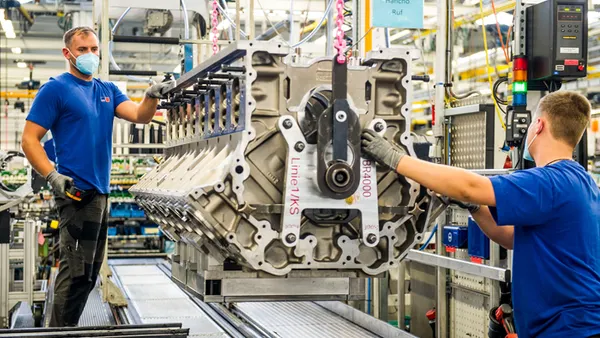

Today, many manufacturers hope to improve their operations by onboarding 3D printing to strengthen their supply chains’ resilience. By producing parts layer-by-layer from digital files, additive manufacturing enables the customization of parts on a mass scale that potentially perform better, cost less and can be produced on demand, paving the way for faster innovation while reducing the need for spare-part inventories.

Accelerating the adoption of additive manufacturing technologies is a strategic priority for the Biden administration to improve American manufacturing competitiveness. Biden’s Additive Manufacturing (AM) Forward Initiative's intent is to help suppliers scale and qualify their machines and processes, which can require significant investment.

Several complexities and limitations must be evaluated in order to adopt additive manufacturing as a mitigating means for solving supply chain challenges, including but not limited to available materials, technologies and the work required after a part is printed, referred to as post-processing.

Regulatory requirements must also be satisfied, which can be costly and time consuming if additive manufacturing represents a significant manufacturing change over the previously certified process. Finally, if additive manufacturing is a new capability in a company’s portfolio, training or upskilling the workforce for the new manufacturing technology must be undertaken, which adds additional time to the schedule.

All of these investments must be weighed against a company’s strategic need for a secure supply of a certain component in the future, along with the advantages of building an additive manufacturing capability in-house for the long term.

Assess the viability of additive manufacturing

Validating the viability of incorporating 3D printing into a workflow requires that the answers to the above considerations provide the ‘green light’ to proceed.

Companies colloquially called “service bureaus” can provide advice around these onboarding and roadmapping aspects of additive manufacturing, as well as provide 3D printing services. For critical parts in regulated industries like aerospace, defense, and medical devices, original equipment manufacturers will need to provide direction.

While the number and types of parts that have been produced with additive manufacturing has significantly expanded over the last decade, the materials available for additive manufacturing – polymers, metals and ceramics — remain limited, which in turn may limit the technology’s use on certain applications.

The attributes and outcomes of different additive manufacturing technologies vary widely. The technology must be able to accommodate the part’s size and required mechanical and material characteristics. For example, directed energy deposition 3D-printing produces parts measured in meters, but with surface roughness and feature sizes that necessitate subsequent machining. Powder bed laser fusion can make parts measured in centimeters to millimeters, with much less machining required.

The post-processing of the component is often overlooked, but also plays a critical role in the performance of the part. Post-processing includes powder removal, support removal, heat treating, machining, surface finishing and other processes depending on the material system and its application, such as hot isostatic pressing, electroplating, anodizing, painting or chemical milling.

Balance investments with strategic needs

Once the feasibility of 3D printing a part is confirmed, the strategic need for the new capability must justify the investments required in equipment, training and infrastructure.

This evaluation will be unique in almost every instance. If a company chooses to work with an additive manufacturing service bureau that has proven equipment and infrastructure, for example, then it will not need to invest in equipment, infrastructure and workforce training.

By contrast, if a company wants to have greater control over preventing potential delinquent parts by onboarding additive manufacturing into its capabilities, investments in capital equipment, peripheral equipment, computer software, infrastructure and training will be needed.

Some aspects of additive manufacturing infrastructure can be quite costly, such as printing combustible materials like aluminum alloys, which require special building enclosures that must be permitted by the governing city fire department. It should be noted that it is much more costly to print metal parts than polymer parts, such as the example of the face shields discussed above.

Finding and developing the technical know-how to 3D print parts is similarly costly. Additive manufacturing is not as simple as buying a machine and pressing a button, especially when printing metals. Engineering design margins for redesigning a part to make it suitable for additive manufacturing and creating the significant database required to demonstrate the printing process is stable and repeatable can take years.

Investments in the creation of large databases necessary to demonstrate the reliable performance of the 3D printing machine and the parts and material it is creating can also be substantial. Demonstration of reliable performance is required for aerospace and defense, and this process can take several years to establish in these more carefully regulated industries.

All these investments must be weighed against a company’s need to create a stable supply of required components. While the costs and ramifications of part shortages may be minor for industries like consumer products, where substitutes may be widely available, they can be exorbitant in heavy industries, far outweighing the investment required for additive manufacturing alternative solutions. In the aerospace industry, for example, even a seemingly inexpensive part can hold up an entire production line if it is missing.

The business case for 3D printing a part is not a simple comparison of the cost of producing a traditional part versus the cost of an additively manufactured alternative, which will often be higher. In the aerospace sector, if a missing and inexpensive part is holding up the production of a large complex aircraft, the cost of delivery delay will likely be greater than the cost of an additively manufactured alternative that would arrive in a more timely and predictable manner.

Develop a strategic supply chain advantage

Additive manufacturing technologies are rapidly evolving, and it’s clear we are just beginning to tap their full potential. Manufacturers and suppliers that learn how and when to apply these advanced technologies will develop a strategic supply chain advantage as their part lead times and material costs decrease.

Adopting new technologies can be difficult, expensive and time consuming, but investing in and developing new technologies can provide a competitive advantage by increasing innovation, stabilizing production and minimizing supply chain shortages.