Boeing continues to recover as the company’s second quarter revenue surged approximately 35% year-over-year to roughly $22.7 billion, reflecting higher commercial plane delivery volume, according to an earnings release Tuesday.

Net losses for the quarter dropped nearly 58% to $612 million, compared to $1.4 billion YoY. Additionally, the plane manufacturer has rebounded financially in the first half of the year, with revenue for the first six months increasing 26.4% to $42.3 billion compared to the same period last year.

Commercial plane deliveries from H1 have also surpassed distribution numbers YoY. Boeing delivered 280 aircraft, making it the most deliveries in Q2 and the first six months of the year since 2018, President and CEO Kelly Ortberg said during an earnings call Tuesday. The company delivered 194 commercial planes in the second quarter and 378 commercial units in the first six months of 2018.

“It’s clear our recovery plan is taking hold,” Ortberg said. “We’re making steady progress to stabilize our business, strengthen development program execution and change our culture to set up for the future.”

Stabilizing to increase commercial plane production

Earlier this month, the National Transportation Safety Board released its final report, which found that the plane maker failed to provide “adequate training, guidance and oversight” to its factory workers, leading to the mid-exit door plug on Alaska Airlines that blew out midair on Jan. 5, 2024.

The incident led the Federal Aviation Administration to cap Boeing’s 737 production at 38 planes a month. Since last year’s Alaska Airlines incident, Boeing has spent billions of dollars to fix its production woes and the company is seeing the benefits of its ongoing investments in stabilizing its production system, Ortberg said. The company has been using key product indicators to measure the stability of its production system, which are part of Boeing’s safety and quality improvement plan it submitted to the FAA last year. The manufacturer progressively increased 737 production over the past year, finally reaching 38 units per month in Q2.

Ortberg highlighted Boeing’s recent actions to improve its processes, including reducing traveled work by 50% and addressing employee feedback from its safety and quality standdowns, the CEO added. Additionally, Boeing engaged in structured on-the-job training as well as “simplified” 1,500 work instruction documents. Moreover, the company aims to shut down its shadow factory in Q3.

The plane manufacturer has also implemented KPIs for its other commercial aircraft in an effort to stabilize operations and increase production rates. The KPIs are being used at Boeing’s 787 Dreamliner facility in Charleston, South Carolina, where the production rate is seven units per month, Brian West said during his last call as the company’s CFO and finance EVP. Boeing announced last year that it’s investing $1 billion to expand and upgrade two 787 Dreamliner campuses in North Charleston, South Carolina, as it aims to ramp up manufacturing to 10 planes a month by 2026.

“This is critical to our performance to deliver safe and high-quality aircraft on time to our customers and steadily execute our planned production increases,” Ortberg said.

Boeing anticipates being in a position to request approval from the FAA to increase production to 42 aircraft per month in the coming months. Despite the “good progress,” the company still has a lot of work to do, Ortberg said.

Boeing also made executive changes recently. West will become a senior advisor to Ortberg, with Jesus “Jay” Malave, former CFO of Lockheed Martin, succeeding him, effective Aug.15. Boeing also named Stephen Parker as president and CEO of its Defense, Space, and Security business, effective immediately. Parker served as the segment’s interim head since Ted Colbert left the company in September 2024.

Mitigating tariffs

The company expects to incur less than $500 million in tariff impacts, Ortberg said. While Boeing’s finances are on the upswing, the recovery could be impacted by tariffs if deals are not reached by the Aug. 1 and 12 deadlines, according to a securities filing.

Approximately 80% of its commercial supply chain spending is allocated to suppliers in the United States, and around 80% of its commercial deliveries are made to customers outside the U.S., Ortberg said.

Nevertheless, the company is encouraged by some of the bilateral trade agreements recently announced, including the U.S. deal with the European Union, West said. The two countries agreed to zero-for-zero tariffs on “a number of strategic products,” including aircraft and component parts.

Another relevant deal is the U.S. agreement with Japan, as one of Boeing’s key areas is the equipment the company imports from Japan. The pact includes provisions for increased U.S. energy and aerospace exports. Additionally, the White House stated that Japan is expected to purchase 100 Boeing aircraft.

However, Boeing is monitoring the trade environment, particularly with Canada, Mexico and Italy concerning its suppliers. The company is also closely tracking negotiations with China, as the country is a significant market for Boeing’s commercial aircraft.

While the U.S. and China reached an agreement last month, the deal has yet to be finalized. Still, Ortberg doesn’t expect to see additional tariffs going forward.

“As a leading U.S. exporter, ongoing free trade is important to our business,” Ortberg said. “Our top priority is promoting continuity of supply, and we’re working across the supply chain to ensure suppliers are focused on meeting the strong market demand.”

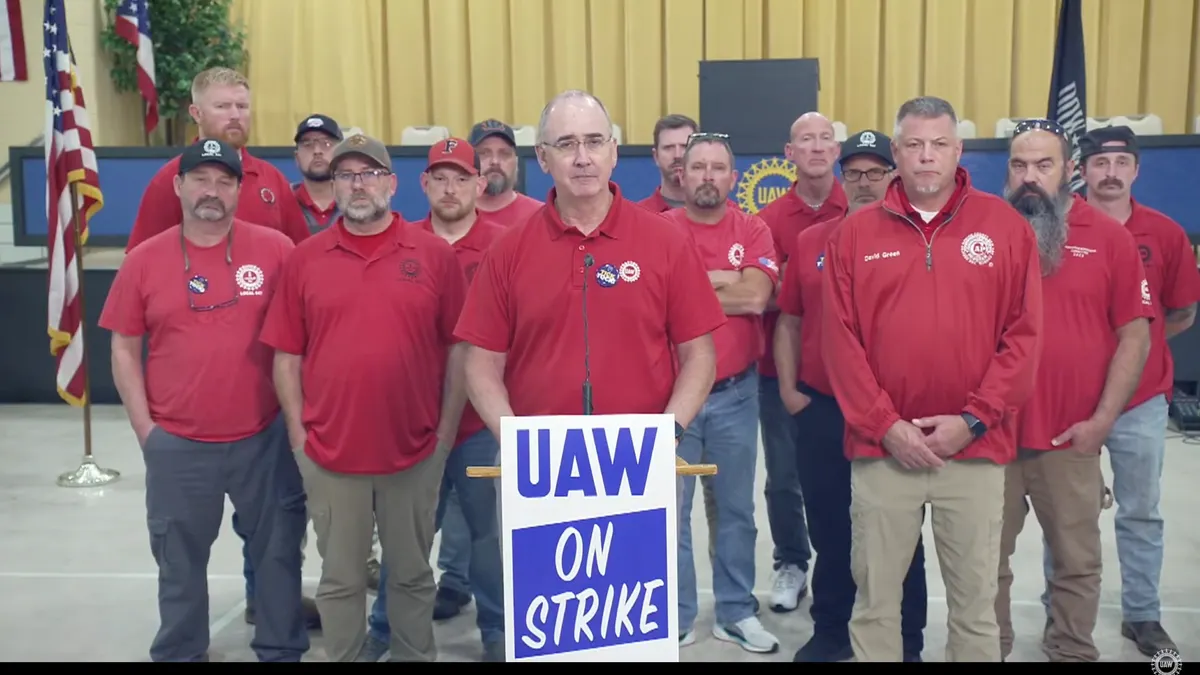

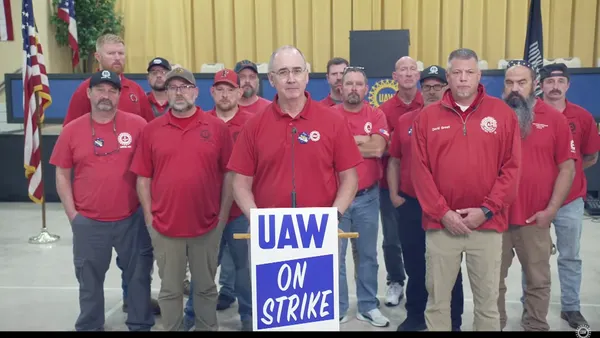

Another pending strike on the defense side

Boeing may face another workers’ strike later this month, this time at its fighter jet facilities in St. Louis and St. Charles, Missouri; and Mascoutah, Illinois.

Boeing and the International Association of Machinists and Aerospace Workers District 837 initially reached a tentative agreement last week in which the labor union voted to reject the offer, according to the machinists website.

The current contract expired July 28 and is followed by a seven-day cooling-off period before a strike would begin Aug. 4. Boeing and IAM District 837 resumed negotiations on Thursday and the company proposed its “last, best and final offer” that withdrew alternative workweek schedules, added a reward for good attendance at $0.50 an hour, and a $5,000 bonus if the contract is ratified by the end of Sunday. If the union votes to reject the offer, Boeing said it'll withdraw the $5,000 ratification bonus.

IAM District 837 will vote on Boeing’s modified offer on Sunday. If the union votes to reject the proposal, a strike will begin the following day.

“We’ve activated our contingency plan and are focused on preparing for a strike,” Boeing said in a July 27 statement.

Ortberg said that if a strike occurs at its Missouri and Illinois facilities, the company will manage through it, since the employee numbers there are significantly smaller than at its Washington and Oregon sites.

The company experienced a nearly two-month work stoppage last year due to 33,000 IAM District 751 and W24 workers striking at the company’s commercial aircraft facilities on the West Coast, contributing to a significant loss of $11.8 billion in 2024.

Editor’s note: The story has been updated to include information regarding Boeing’s modified offer.