For the last 50 years, Semicon West, one of the microelectronic industry’s biggest conferences, has been held in the San Francisco area. However, for the first time since its inception, next year it’s moving to Phoenix, Arizona, as the area becomes a hub for semiconductor manufacturing.

“Greater Phoenix is home to more than 75 semiconductor companies including SEMI members EMD Electronics, Intel, and Taiwan Semiconductor Manufacturing Company,” Joe Stockunas, president of SEMI Americas and host of the event, said in a statement announcing the change.

In just the last four years, the Phoenix metro area saw 14 major manufacturing announcements and was ranked number one in the U.S. for manufacturing construction.

Arizona’s semiconductor storyline begins in 1949, when Motorola opened a research lab in Phoenix that later manufactured transistors, a type of semiconductor, Phoenix Mayor Kate Gallego said in an email. Then, ASM came to Phoenix in 1976, followed by Intel opening its first semiconductor factory in Chandler in 1980, becoming one of the state's largest employers.

As major players in the industry started accumulating here, related companies and suppliers followed, building a strong manufacturing ecosystem in the region.

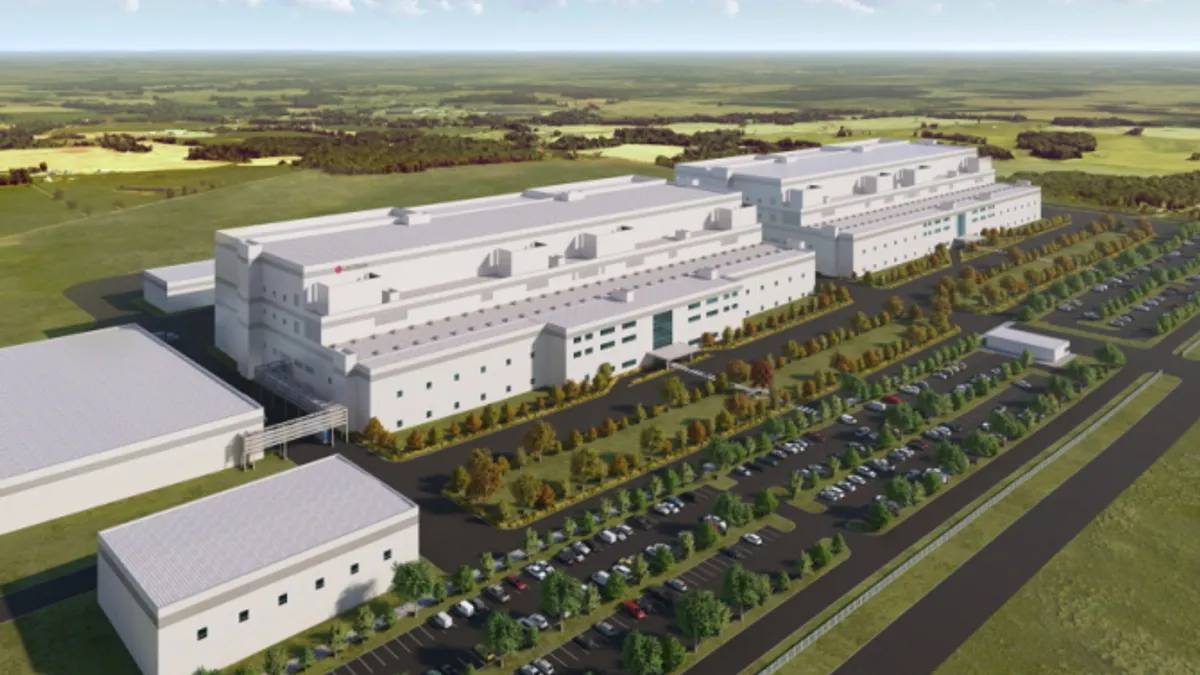

In May 2020 TSMC added to this mix, with plans to build three fabs in Arizona worth a combined $65 billion, the largest foreign direct investment in the state’s history.

Talent pipeline creates a draw

The state’s efforts and incentives to attract manufacturers combined with one of the nation’s strongest talent pipelines in the semiconductor industry, have helped draw mega projects like TSMC’s to Arizona, according to the chipmaker.

“As we were considering different sites in the U.S., the Arizona team made a strong impression with their preparedness and understanding of the range of issues and criteria for our decision,” a TSMC Arizona spokesperson said. “The team assembled included top elected leaders in city and state government, economic development, utilities, and higher education.”

Gallego said the state’s partnership with Arizona State University and the school’s growing engineering program were some of the top reasons for “getting TSMC to commit to Phoenix,” the mayor said in an email.

“ASU is a major partner on workforce development initiatives and is helping bridge the gap between when new technology is invented and when it’s made and deployed,” Gallego said.

The state has also partnered with Maricopa Community Colleges, where it sponsored the Route to Relief program and Semiconductor Quick Start courses, which aim to introduce people to the possibilities in the semiconductor manufacturing and trade industries.

“In partnership with the state, industry, and federal government, the City also launched a Registered Apprenticeship program, the first of its kind in the country, to help train the next generation of semiconductor technicians,” Gallego said.

TSMC plans to invest $5 million to train 80 facility technician apprentices over five years. The pilot program was launched with a cohort of eight facilities technician apprentices, all of whom have become full-time TSMC employees and will be a part of an 18-24 month program consisting of on-the-job training and classroom instruction, according to the company spokesperson.

The company plans to expand the program to other fab technician roles beginning next year.

Where manufacturers go, suppliers follow

With the growing support of state and city officials, a rapidly developing talent pipeline and the increasing impact of major projects like the TSMC fabs, the area is seeing a “massive influx of semiconductor-related companies completing the industry supply chain,” said Chris Camacho, president and CEO of the Greater Phoenix Economic Council.

“GPEC has since located 39 semiconductor-related companies to the region, creating more than 7,700 jobs and over $37 billion in capital investment,” Camacho said.

One such company is Benchmark Electronics, which builds equipment to produce semiconductor chips. The company opened a new facility in Mesa, Arizona last year.

“To put it simply, we love being located near a lot of our customers,” said Ryan Rounkle, VP of the semiconductor capital equipment sector at Benchmark. CHIPS and Science Act incentives and the strong technical talent pool further supported the decision to move here, Rounkle said.

Like TSMC, the company partners with local educational institutions like the Grand Canyon University and ASU to build the necessary workforce.

The state has also added new legislation that decreased property taxes for many semiconductor companies and reimbursements related to major public infrastructure improvements.

“Manufacturers and suppliers are attracted to our environment that offers a favorable corporate tax structure and tax credits, and a minimalist regulatory approach in addition to competitive labor, land, and operating costs,” Camacho from GPEC said.

Since 2020, the state has welcomed more than 40 semiconductor projects, representing over $102 billion in capital investment and more than 15,700 direct jobs, according to the Arizona Commerce Authority. The numbers are likely to go up as Intel and TSMC’s projects begin production.