Dive Brief:

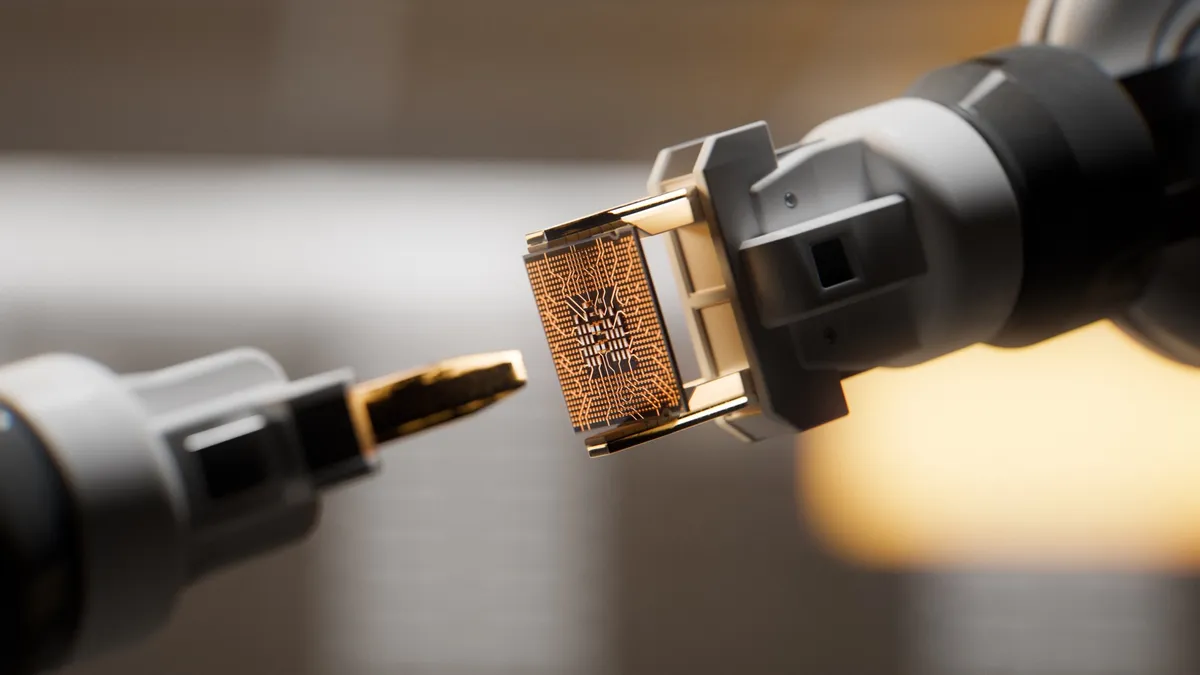

- Seismic shifts in IT infrastructure could trigger a chip shortage over the next several years, according to Bain & Company’s fifth annual global technology report.

- The management consulting firm expects artificial intelligence workloads to grow 25% to 35% annually over the next several years, pushing the market for AI-related hardware and software to between $780 billion and $990 billion by 2027.

- Demand for AI components could grow 30% or more by next year, outpacing current production capacity. “If data center demand for current-generation GPUs were to double by 2026, not only would suppliers of key components need to increase their output, but makers of chip packaging components would need to nearly triple their production capacity to keep up with demand,” the report said.

Dive Insight:

As enterprises move AI plans forward, the technology is reshaping infrastructure on every level, from tiny microprocessors to massive data centers. The software market, too, has felt the impact, with major vendors like Microsoft, SAP and Salesforce racing to infuse CRMs, ERPs and office productivity tools with large language model capabilities.

Bigger models and larger data centers coupled with a proliferation of enterprise applications could push the overall AI market to nearly $1 trillion in just three years, up from under $200 billion in 2023, according to Bain. The firm expects AI hardware and software to experience a 40% to 55% growth spike each year through 2027.

“We have a genuine surge in demand and, within that demand, there's a meaningful mix change towards parallel compute and towards compute with advanced packaging,” David Crawford, chairman of Bain’s global technology practice and lead author of the report, told CIO Dive.

While downstream effects on the enterprise are hard to foretell, Bain has already detected constraints on the GPU supply chain, according to Crawford.

“We have had our clients complaining about access to components — particularly to GPUs — for at least 12 to 18 months,” Crawford said.

Vendors have long limited access to GPUs amid high demand. “It's become a strategic advantage if you do have access to the amount and number that you want.”

As data and application modernization drives up enterprise cloud spend, IT and finance executives are grappling with budget constraints. The AI boom has made rising cloud bills unmanageable for most companies, according to a recent Tangoe report.

The immediate costs are reflected in an acceleration of multibillion-dollar cloud infrastructure investments by hyperscalers AWS, Microsoft and Google Cloud — and by record lows in commercial data center vacancy rates. Capital spending on cloud facilities is expected to grow by 36% year over year in 2024, per the Bain report.

At the data-center level, those investments face electrical grid capacity bottlenecks and a potential shortage of specialized workers, according to Bain’s analysis. “Utilities are already fielding requests from hyperscaler customers to significantly expand electrical capacity over the next five years,” the firm said.